Saving money can seem tricky, but it’s a lot easier with the right tools. Our Savings Goals Checklists are here to help you plan and reach your savings targets. Whether you’re saving up for a down payment, a fun vacation, or your future retirement, these checklists will keep you on track. They help you set clear goals, track your progress, and make sure you’re saving enough each month. With these handy templates, saving money will be more organized and less stressful. Let’s get started on making your savings dreams come true!

Ready to take control of your financial goals? Our collection of free, downloadable templates is designed to help you stay organized and focused on your savings journey. Each template is easy to use and customizable to fit your unique needs.

Here’s a quick overview of what you can find:

Plan and track your progress towards saving for a down payment on a house or vehicle.

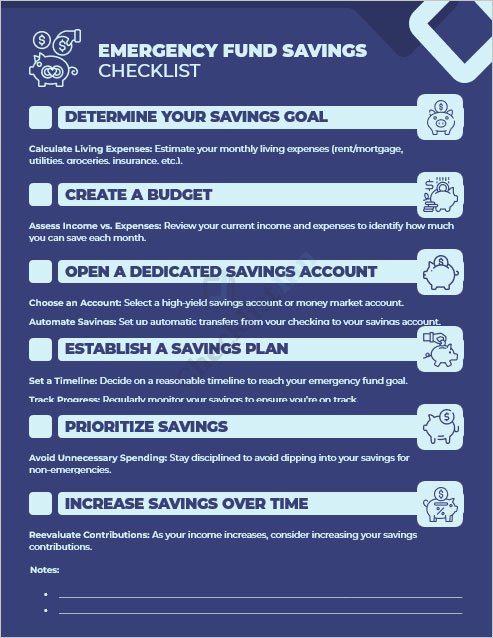

Build and maintain a safety net for unexpected expenses.

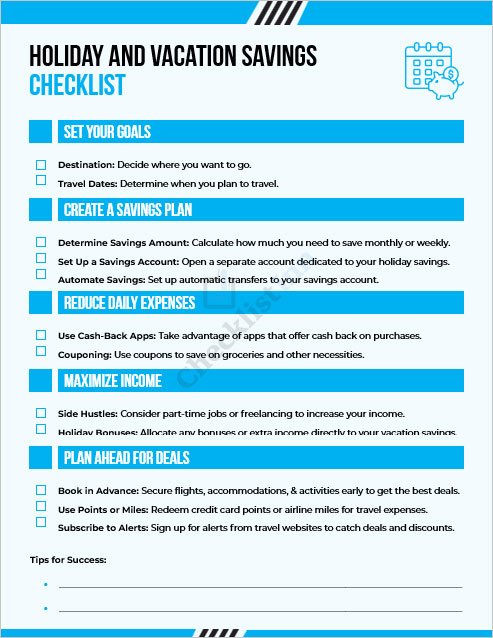

Save up for special occasions and trips, ensuring you can enjoy them without financial stress.

Set and achieve goals that require a longer time frame, like buying a home or funding education.

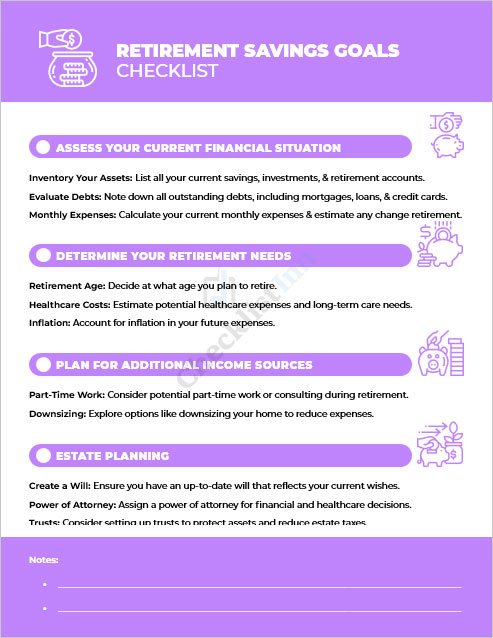

Prepare for your future by planning and tracking your retirement savings.

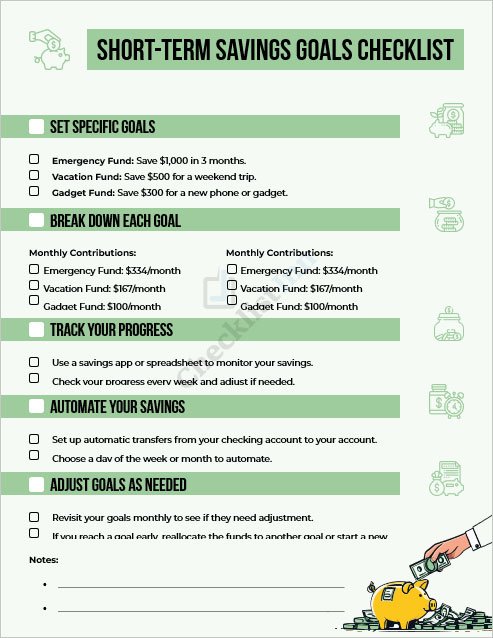

Manage goals that are closer to the present, such as buying a new gadget or taking a short trip.

Explore our templates today to find the perfect tool for your financial journey and start achieving your savings goals!

Setting savings goals is like having a map for your money. It helps you know where you want to go and how to get there. Without clear goals, it’s hard to stay focused and motivated.

By following these tips, you’ll create savings goals that are clear, realistic, and motivating. Start setting your goals today, and watch your savings grow!

Maintaining a financial plan requires discipline and consistency. Here are some practical strategies to help you stay on track and avoid common pitfalls:Tip Description Automate Transfers Set up automatic transfers from your checking account to your savings account. This way, you’ll set money aside regularly without having to think about it. Set Clear Reminders Use phone alarms, calendar reminders, or sticky notes to prompt you to review and adjust your plan as needed. Adjust Goals as Needed If you find your targets are too challenging or too easy, don’t hesitate to adjust them. This keeps your plan realistic and achievable. Track Your Progress Regularly Regularly check how you’re doing to stay motivated. Seeing your progress can boost your confidence and keep you on track. Create a Budget Make a budget to track your income and expenses. This helps you find extra funds to put aside and ensures you’re not overspending. Reward Yourself for Milestones Celebrate small victories when you reach your targets. Rewards can keep you motivated and make the process more enjoyable. Avoid Temptation Identify and avoid spending triggers. If you know certain situations lead to unnecessary expenses, find ways to avoid them or handle them differently. Seek Support Share your goals with friends or family. They can offer encouragement and help keep you accountable.

By using these strategies, you can stay disciplined, avoid common pitfalls, and achieve your financial goals more effectively.

Tracking your savings is like keeping an eye on your progress as you work towards your goals. It’s a simple but powerful way to stay motivated and on track.

Tracking your savings helps you stay motivated, organized, and on top of your goals. Start tracking today and enjoy the benefits of seeing your hard work pay off!