Stay organized and stress-free with ChecklistInn’s free, editable bill payment checklists—your key to timely payments and financial peace of mind.

Managing your monthly bills doesn’t have to feel overwhelming. A simple bill payments checklist helps you stay on top of due dates, avoid late fees, and keep your budget under control. Whether you’re juggling rent, utilities, credit cards, or subscriptions, our free and printable bill payment checklist templates make it easier to organize your finances. Download, customize, and start tracking today to gain peace of mind and stay financially organized.

Manage your bill payments more easily with our handy checklists. Each template is designed to help you stay organized and on top of your finances. Click the links to download each template in MS Word format and start managing your bill payments with ease.

Keep track of annual expenses to avoid surprises.

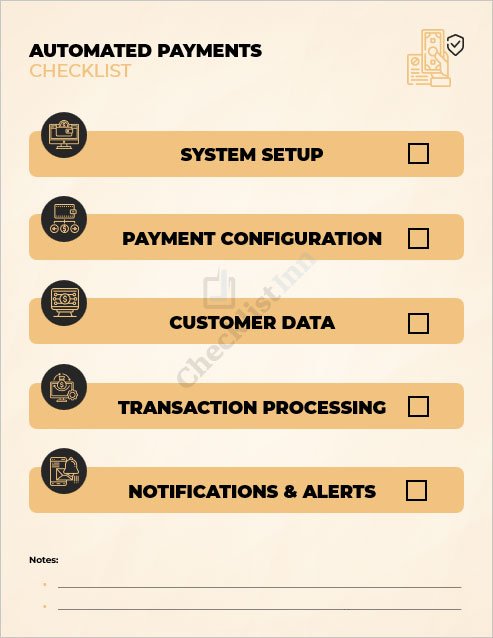

Ensure all your automated payments are up-to-date and correctly set up.

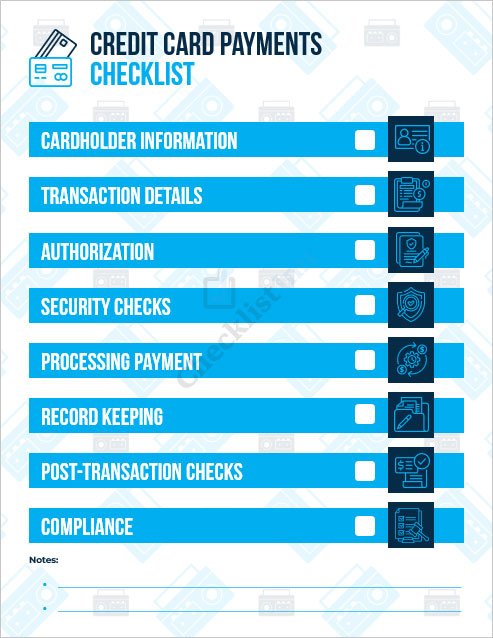

Manage your credit card payments to maintain a healthy credit score.

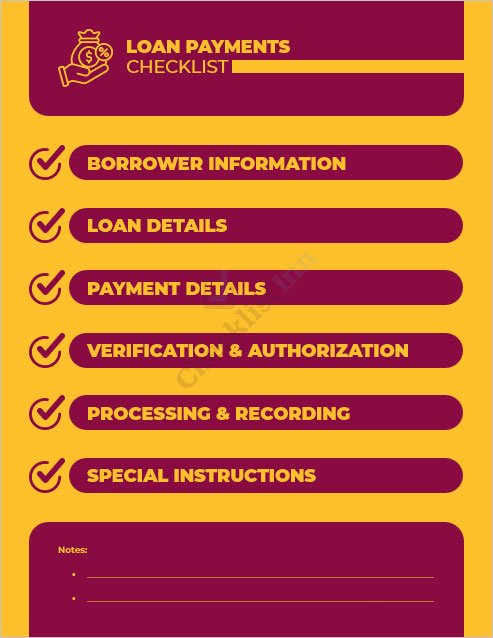

Stay organized with your loan payments and avoid late fees.

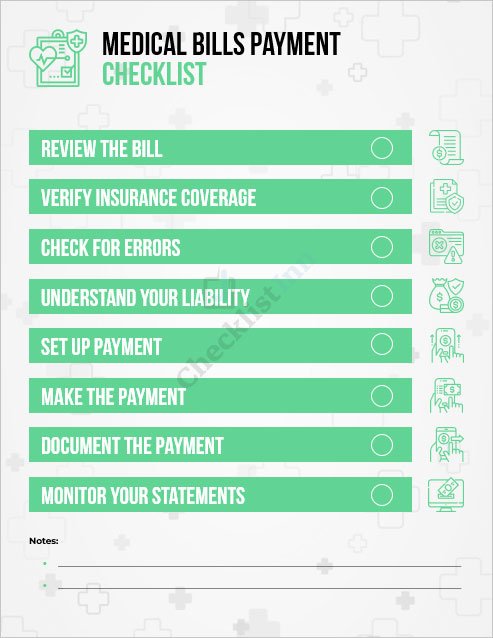

Track and manage your medical bills efficiently.

Keep track of all your monthly bills to avoid missing any payments.

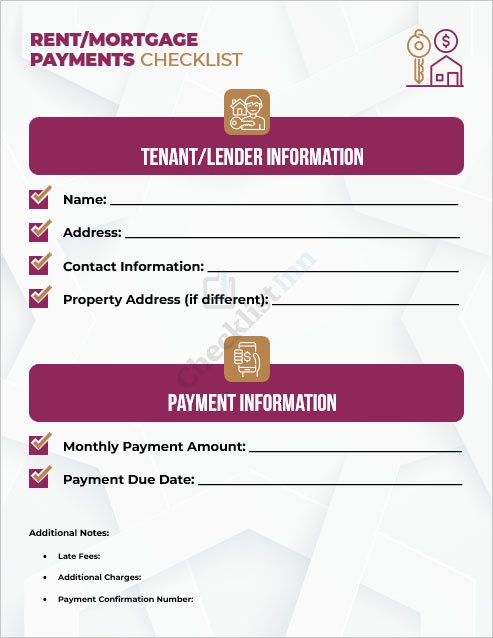

Manage your rent or mortgage payments effectively.

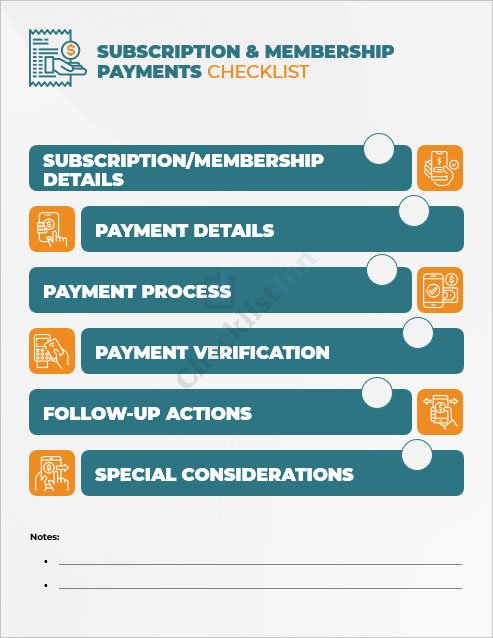

Track your ongoing subscriptions and memberships.

Ensure timely payment of your utility bills to avoid service interruptions.

Staying on top of your bills isn’t just about keeping the lights on—it’s about protecting your finances and peace of mind. Here’s why it’s so important to manage bill payments carefully:

When you take a proactive approach to managing bills, you’re not just avoiding problems—you’re setting yourself up for financial stability and a worry-free future.

Managing bills is easier when you build a few smart habits into your routine:

With these simple steps, you’ll reduce stress, avoid late fees, and stay in control of your finances.

Avoiding a few common mistakes can save you money and stress. Here are the key pitfalls to watch out for:

By avoiding these mistakes, you’ll keep your payments organized, your credit healthy, and your finances stress-free.

A bill payments checklist is a simple tracker for your monthly bills, due dates, amounts, and payment status. It helps you avoid late fees, prevent missed payments, and manage cash flow.

Both work well. Printables are great if you like pen-and-paper. Digital trackers (Excel/Sheets/Apps) make it easy to set reminders, auto-calc totals, and update on the go.

List all your recurring bills, note due dates and amounts, mark the payment method, then review weekly. Add irregular bills (annual/quarterly) so they don’t sneak up.

Pay it as soon as possible, contact the provider to request a fee waiver if it’s a first-time slip, and set up reminders or auto-pay to prevent future misses.

Use average amounts based on past bills, then update the checklist when the new bill arrives. Consider setting a buffer in your budget for seasonal changes.